Americans love their credit cards. People here literally use them for every transaction, all the time. I remember precisely the day I used cash last year: I bought firewood on our anniversary camping trip in April, because the ranger station only accepted bills dropped through a slit in a box (for this reason I always keep some emergency cash in the car). That’s it. The rest of the year I could get by with just a stack of credit cards in my pocket (and my driver license, because they check your ID here every time you buy alcohol). I quickly learned to love and embrace this American idiosyncrasy. In this post I will explain why this country is so obsessed with credit cards, and how I play the credit card game of maximizing my rewards and benefits without spending a single penny on interest.

There are good reasons for always using credit cards. First of all, there is a security aspect to it, as credit card purchases are automatically insured, and unauthorized transactions can be disputed and reversed before any money ever leaves your bank account. You don’t get this kind of protection with your debit card (in Dutch: “pinpas”). In the US, using a debit cards mean you’re vulnerable to fraud, overdraft fees and potential headaches when trying to get your stolen money back.

The poor subsidizing the rich

Then there are the so-called interchange fees: the fees charged by the credit card processing networks (VISA, MasterCard, and American Express) as a percentage of every transaction, payed by the merchant. In Europe, these fees are capped by law at 0.3% for credit cards but in the US they can be as high a 3%. Merchants don’t want to turn away customers by only accepting cash, so they accept these fees and just increase all prices accordingly to compensate for it. Merchant happy. Credit card networks happy. The banks, who partner with the credit card networks to issue the cards and the underlying credit lines (“loans”) are also happy, because they know that people tend to overspend when they don’t see physical money leaving their wallet, resulting in a large fraction of the population paying monthly interest on their credit card debt. Only 33.7% of Americans pay off their credit card bill in full each month to avoid interest payments, according to this study from February 2021. To entice people to use their cards as much as possible, banks return some of the profits from the fees and interest back to the credit card holders in the form of cash rewards or travel points and miles.

Now here is the point: people who don’t use credit cards still pay the increased prices, but don’t receive any of the rewards. It turns out that people with low income, poor discipline and high debt are the ones with the lowest credit scores. These people don’t get easily approved for the fancier credit cards with the highest rewards. In other words: it’s the people with poor credit who are subsidizing the cashback rewards and travel points of the people with good credit. Welcome to America!

So the smart move is to always use credit cards and reclaim some of the interchange fees that everybody is already paying anyway. In addition, you can claim some of the interest and fees paid by the poor and undisciplined, since often the credit card rewards are higher than what can be explained by just the interchange fees alone. The trick, though, is to stay disciplined, never spend more than what your budget allows (keep track of what you spend!), and always pay your credit card bills in full. This way you’ll never pay any interest or late fees and you cannot loose the game. Simple, right? If you follow these steps, and get the right credit cards, you can pretty easily reclaim about 4% of your entire discretionary spending (not including things like rent and utilities, which often charge a fee for using credit cards, defeating the benefit). In my case this comes down to about $1300 in rewards per year (not including the much more lucrative sign-up offers!). Sure, credit cards don’t make you rich, but so far it’s the only hobby I’ve found that pays off, instead of costing me money.

My credit card system

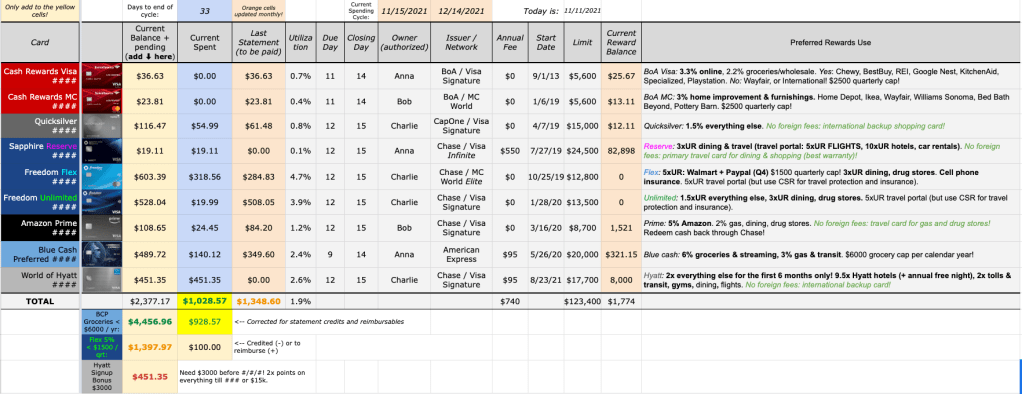

These are the 9 credit cards me and my spouse have collected over the last couple of years. And no, having a lot of credit cards is not necessarily bad for your credit score. On the contrary, having more credit cards and different types of loans is actually boosting your credit score (resulting in better credit card offers and lower interest rates on car loans, mortgages, etc.). As long as you never miss a payment and keep the utilization rate (the fraction of the credit limit you actually use) very low (preferably below 10%, ours is usually 2%).

Every card in this system serves its own purpose:

- Chase Sapphire Reserve ($550 annual fee)

- 3xUR (Ultimate Rewards) points on all travel and dining (equals 4.5% cash back)

- 5-10xUR points on hotels, car rentals and flights when booked through the Chase travel portal (equals 7.5%-15% cash back)

- Priority Pass lounge access when flying (free drinks and food!)

- Travel and lost baggage insurance

- Car rental status (free upgrades) and primary CDW (collision damage waiver, saving on rental car insurance)

- $300 travel credit

- $100 credit towards Global Entry

- Chase Freedom Flex

- 5xUR points on quarterly categories (e.g. groceries, home improvement stores, gas, PayPal, this equals 7.5% cash back when you also have the Sapphire Reserve)

- 3xUR on drug stores and dining (equals 4.5% cash back)

- Chase Freedom Unlimited

- 1.5xUR points on everything else that does not fit in a different category (2.25% cash back with the Sapphire Reserve)

- Amazon Prime Rewards

- 5% cash back on all Amazon purchases

- American Express Blue Cash Preferred ($95 annual fee)

- 6% cash back on groceries (up to $6000) and streaming services (Netflix, Disney+, YouTube Premium, etc.)

- 3% cash back on gas

- Bank of America Custom Cash Rewards Visa

- 3.3% cash back on online shopping (one of the custom categories)

- Bank of America Custom Cash Rewards MasterCard

- 3% cash back on home improvement stores (another custom category)

- Capital One Quicksilver

- 1.5% cash back on everything else (also internationally)

- Chase World of Hyatt ($95 annual fee)

- 9.5x points on Hyatt hotels

- 1 free anniversary night each year

- Discoverist status (preferred room upgrades, late checkout)

Combined, these cards cover all my bases (groceries, travel, dining, gas, online shopping, home improvement) and result in a return on all my spend of about 5% (even after accounting for a total of $740 in annual fees!). Some of the rewards are in the form of cash back, but most rewards are in the form of Ultimate Rewards points that we use to book free flights through the Chase Travel Portal. The system includes the so-called Chase Trifecta (Sapphire Reserve + Flex + Unlimited), where points from the Flex and Unlimited are combined into the Sapphire Reserve account, where they become 50% more valuable and from where they can be transferred to 14 travel partners such as Southwest Airlines and Hyatt hotels. This system also gets us into airport lounges when we’re traveling, we get free Global Entry to speed up the waiting times at border security, we get a free night in a Hyatt hotel each year, and we collect numerous perks, discounts, and offers through the offers programs that all credit card issuers eh… offer.

The system is designed to be relatively easy to use, and work well for the long term. So no churning through cards just for the signup bonuses, no store credit card for every store we visit, and no American Express cards that earn Membership Rewards points, such as the Amex Gold or Platinum. These points could be valuable if you transfer them to Delta airlines or Hilton hotels, but Amex does not partner with Hyatt (my preferred hotel chain), and the travel portal of Chase is much better than the one from Amex. I also don’t like how American Express has changed a lot of its benefits into credits that are really hard to use with your normal spend (such as their monthly Uber or Digital Entertainment credit) or are for very exclusive stores where you normally don’t shop (such as their Equinox or Saks credit). My system of the Chase Trifecta + cash back is much easier to use.

Keeping track

With so many credit cards (and even more new ones coming out every few months), it’s important to keep track of all the benefits and the spending you do (remember, you don’t want to fall in the trap of overspending!). I have created two Google Sheets to help me with this. The first one I use to calculate the rewards of my current setup, based on an expected yearly budget (if you click on the image/link below, select the “Reward Calculator” sheet at the bottom. If you want to change any of the numbers, you’ll first have to select “File” –> “Make a copy”). For a new card, all I have to do is add a new column with the right numbers and formula for how I value the rewards, and I can quickly tell if the return on spend makes the card worth it for me.

The next sheet I use to keep track of my current monthly spending on each card, together with all the other data I need to access fast when I’m out and about (don’t worry about my privacy, I scrambled all the numbers):

With a link to such a sheet on your phone (and the discipline to keep it up-to-date!), you’ll always know how you’re doing with your monthly budget, even with 9 credit cards. A final tip that really helps with this, is to change the due dates of all your cards in such a way that the closing days fall on the same day of the month. The due day is when the automatic payment will process (or your manual payment is due, but I highly recommend you use autopay to avoid late fees!), which is usually between 21 to 27 days after the last statement period has closed. When all credit card cycles close on the same day, that will be the day you reset all the current balances to zero and a new monthly spending cycle begins. This makes it much easier to stay within your budget, avoid lifestyle creep, and never pay a penny of interest or late fees. All while still raking in the best possible rewards.

So there you have it: this is how you beat the banks at playing the credit card game!

Say thanks and help out this blog

If you find these Google sheets helpful, or you just want to help out this blog, please consider using the referral links below for signing up for your next credit card. You will get a generous signup bonus, while I receive a small compensation as well. Chase has a great offer at the moment: in addition to the $200 signup bonus on their Freedom Unlimited or Freedom Flex (both no annual fee cards!), you’ll earn 5% cash back on grocery store purchases on up to $12,000 spent in the first year (not including Target or Walmart). The Amex Blue Cash Preferred (the best card for groceries) has a generous $300 signup bonus, and the very easy to use Capital One Quicksilver (1.5% on everything) offers $200:

Leave a comment